A recent study conducted by McKinsey & Company has unveiled new findings regarding alternative seafood solutions. The reprinted with the courtesy of McKinsey & Comapany will furnish you with useful information about the topic.

Billions of people rely on healthy oceans as a source of jobs and food, and demand for fish protein is only increasing. Projections show growth of 14 percent by 2030 versus 2020 levels, driven by growing markets in Asia, Europe, Latin America, and Oceania.1 That said, the amount of wild-caught seafood remains flat, with more than 85 percent of the world’s fisheries pushed to or beyond their limits.2

Billions of people rely on healthy oceans as a source of jobs and food, and demand for fish protein is only increasing. Projections show growth of 14 percent by 2030 versus 2020 levels, driven by growing markets in Asia, Europe, Latin America, and Oceania.1 That said, the amount of wild-caught seafood remains flat, with more than 85 percent of the world’s fisheries pushed to or beyond their limits.2

This means future growth cannot rely on incremental growth in wild-caught seafood. And while aquaculture has been the primary source of new fish supply in recent years, it has not been able to keep pace with demand. So-called alternative seafood—substitutes for popular fish and shellfish such as tuna, salmon, and shrimp—provides one way to help scale seafood and provide high-end protein. Although still in its early days, alternative seafood shows significant potential across three production options, each with its own advantages: plant-based, fermentation-enabled, and cultivated.

In this article, we explore the constraints facing seafood markets, as well as challenges specific to popular types of seafood. Our research dives into solutions and products that are either on the market today or likely to be in the years to come. Throughout, our interviews with innovators in the alternative seafood space offer varying perspectives on how the industry can develop.

Global demand is increasing, but barriers to scaling production remain

Demand for seafood is growing quickly. Typically, when a country’s GDP increases, per-capita protein consumption also increases, with the breakdown of protein source varying widely by country. For example, a recent survey in Singapore showed a fivefold increase in the desire to purchase seafood compared with only ten years ago.3

This raises the question: as more nations develop, will there be enough seafood to meet growing demand? In many parts of the world, fish are harvested more quickly than their stocks are replenished. Since the 1990s, global catches have declined by about 1 percent per year, primarily due to overfishing.4 To achieve well-managed fisheries, many regions have limited existing fishing licenses, which has made new quotas a scarce resource.

This raises the question: as more nations develop, will there be enough seafood to meet growing demand? In many parts of the world, fish are harvested more quickly than their stocks are replenished. Since the 1990s, global catches have declined by about 1 percent per year, primarily due to overfishing.4 To achieve well-managed fisheries, many regions have limited existing fishing licenses, which has made new quotas a scarce resource.

Despite this, the OECD projects that global fish production will reach 203 million metric tons (Mt) by 2031, with aquaculture production accounting for 108 Mt, surpassing wild catch around 2024.5 In other words, seafood production will continue to grow despite the plateau in wild catch—but this may not be enough. Although the past decades have brought significant innovation and new technological solutions for farming fish, supply has not been able to keep up with demand for popular species, such as salmon. This lack of supply is primarily driven by regulatory constraints around new farming licenses, some of which are imposed to secure sustainable farming, as well as protections for wild fish.

Alternative seafood products don’t face these restrictions, making them one option for scaling production. Plant-based fish sticks have existed for many years. More recently, alternative seafood has seen the emergence of “whole cut” products and sushi-ready items, such as those that replicate smoked salmon. These and other innovations pose an attractive path forward for the industry.

How the alternative-seafood industry can learn from alternative meats

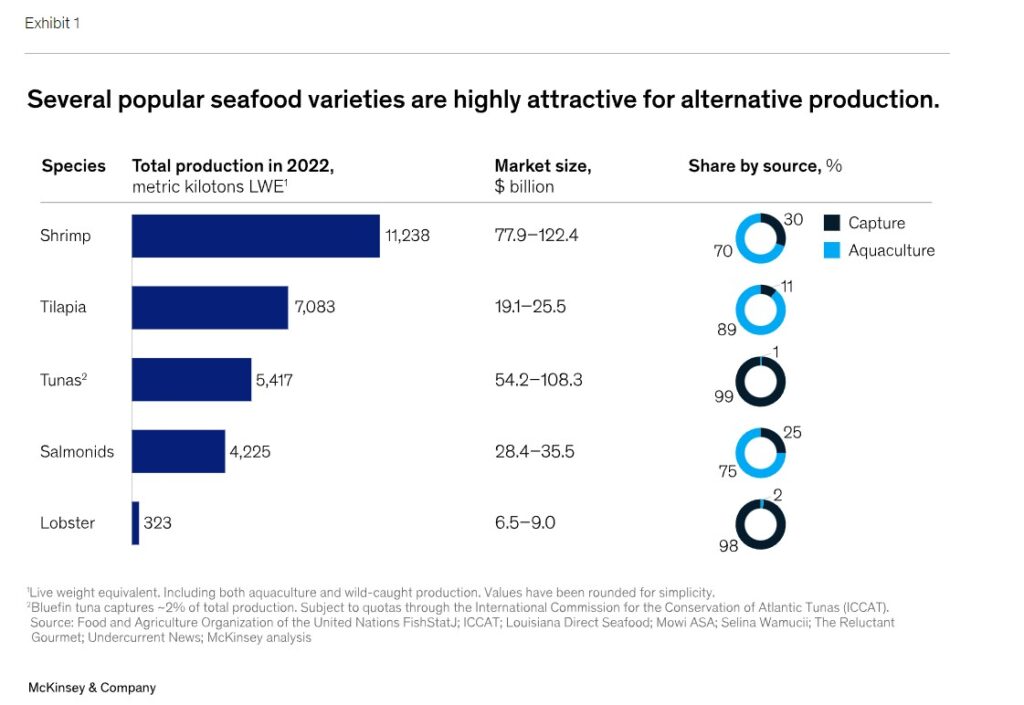

To date, alternative proteins have focused on three widely consumed meat types: chicken, pork, and beef.6 But seafood is a much more diverse food class, with several species consumed in large volumes around the world. In an effort to understand the potential value proposition for alternative seafood at the species level, we looked at several popular seafood varieties and made comparisons around total production, share by source, and market size (Exhibit 1).

As an example, the tuna market is the third largest in terms of annual production. It is also among the most vulnerable to overfishing, the most difficult in terms of aquaculture production, and has a carbon footprint at the retail level of about 0.8 to 0.9 kilograms of CO2 per kilogram.7 In addition, there are different price points and consumer expectations depending on the species, whether albacore, bluefin, or other premium tuna steaks. Players developing alternative-seafood products will need to consider all of these points when making strategic decisions.

As an example, the tuna market is the third largest in terms of annual production. It is also among the most vulnerable to overfishing, the most difficult in terms of aquaculture production, and has a carbon footprint at the retail level of about 0.8 to 0.9 kilograms of CO2 per kilogram.7 In addition, there are different price points and consumer expectations depending on the species, whether albacore, bluefin, or other premium tuna steaks. Players developing alternative-seafood products will need to consider all of these points when making strategic decisions.

Before alternative seafood can scale, it will need to strike a balance between overcoming challenges and finding potential sources of advantage.

Challenges to overcome

Alternative seafood faces several challenges in its efforts to scale:

Price. Perhaps the most significant challenge for the alternative-seafood industry is bringing the cost of production down to a level that’s comparable to what consumers are currently paying for higher-end species. In turn, these higher-end species are attractive for producers of alternative options, at least for the time being, because their target prices are more achievable. In fact, this is part of alternative seafood’s competitive advantage over meat: fish often sells at a higher price point. For example, some types of seafood, such as bluefin tuna, can cost $40 to $200 a pound for premium or super premium cuts,8 which is a much easier price point to hit than $4.99 a pound for ground beef.

Price. Perhaps the most significant challenge for the alternative-seafood industry is bringing the cost of production down to a level that’s comparable to what consumers are currently paying for higher-end species. In turn, these higher-end species are attractive for producers of alternative options, at least for the time being, because their target prices are more achievable. In fact, this is part of alternative seafood’s competitive advantage over meat: fish often sells at a higher price point. For example, some types of seafood, such as bluefin tuna, can cost $40 to $200 a pound for premium or super premium cuts,8 which is a much easier price point to hit than $4.99 a pound for ground beef.

Customer acceptance. Simply stated, consumers will expect a high level of quality from alternative seafood. The wide variety of fish and shellfish adds an extra layer of challenge. As an example, whitefish, eel, and crab vary in their “fishiness,” saltiness, and texture. These particularities will be further influenced by regional relationships to seafood. Communities known for lobster fishing could have a harder time accepting alternative shellfish, while communities accustomed to high-quality sushi could have a harder time accepting sushi substitutes. All of these points will likely need to be considered when scaling markets and finding customer acceptance.

Potential sources of advantage

At the same time, alternative seafood has some distinct advantages that will help the industry scale:

Local production. For fresh seafood shipped via intercontinental air freight, transportation costs can exceed $1 per pound and produce about three times the CO2 emissions as fish transported by road, ferry, or ship.9 By contrast, alternative-seafood products can be produced locally, eliminating the need for costly, time-consuming, and polluting transportation.

Mercury levels and overall health. Although fish and shellfish are excellent sources of protein and omega-3 fatty acids, they can also contain high levels of mercury. Because of this, the US Environmental Protection Agency

advises people in certain vulnerable groups to avoid frequently consuming fish and shellfish that are high in mercury. And a recent report from the European Food Safety Authority explains that heavy consumers of fish meat could exceed the acceptable weekly intake of mercury six times over.10 Alternative seafood can incorporate the benefits of omega-3s while avoiding the risks of mercury.

Harvesting and farming licenses. Today, it can be difficult to obtain new farming licenses for popular species such as salmon as well as quotas for species such as cod. Alternative seafood does not have these supply limitations, enabling entrepreneurs to build new alternative-seafood businesses without having to apply for farming and fishing licenses.

Developing the alternative-seafood industry

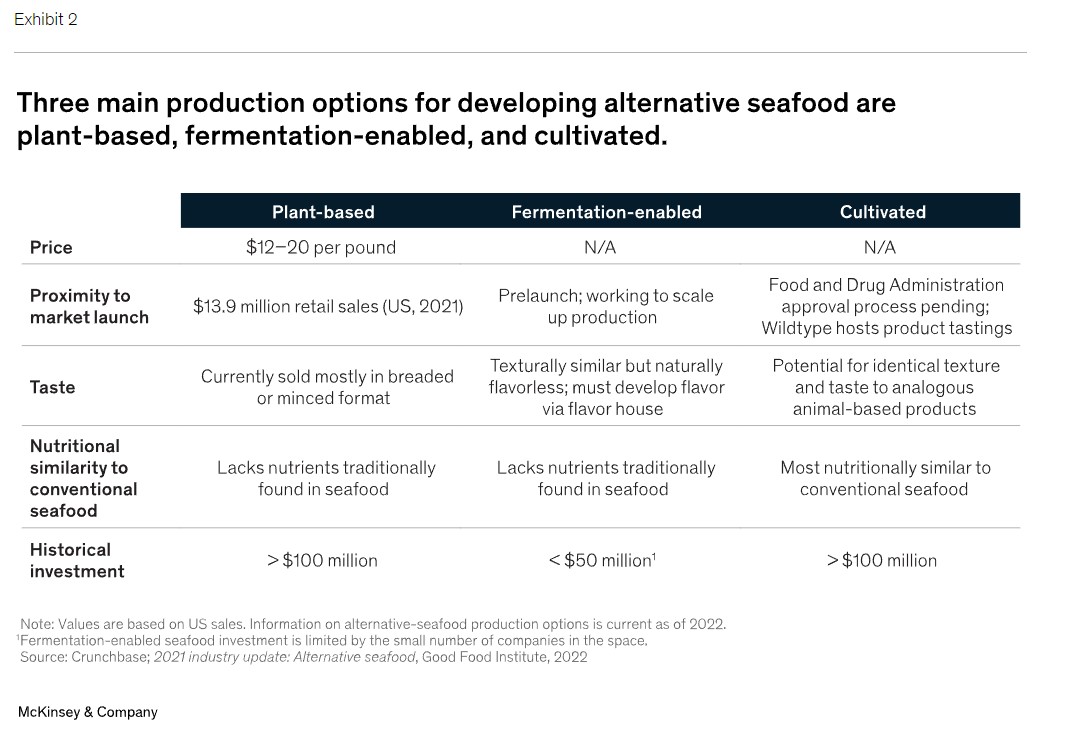

There are three primary production options for alternative seafood: plant-based, fermentation-enabled, and cultivated (Exhibit 2).

Plant-based. This refers to vegan alternatives that make use of soy, seaweed, yeast, legumes, and various vegetable oils and starches. Plant-based seafood has already entered the market in the form of alternative tuna, salmon caviar, scallops, squid, crab, and shrimp. Plant-based products have led the alternative-protein market, in part because they make use of widely available ingredients and require less investment in biotechnology. These products are also subject to fewer regulations and barriers to market, as their technologies typically use GRAS–certified products and don’t require premarket approval. Regulatory issues have mostly focused on product names and labels. Biologically, these products are distinct from the proteins that they emulate—they are designed to look, taste, and feel like seafood but differ on a molecular level.

Plant-based. This refers to vegan alternatives that make use of soy, seaweed, yeast, legumes, and various vegetable oils and starches. Plant-based seafood has already entered the market in the form of alternative tuna, salmon caviar, scallops, squid, crab, and shrimp. Plant-based products have led the alternative-protein market, in part because they make use of widely available ingredients and require less investment in biotechnology. These products are also subject to fewer regulations and barriers to market, as their technologies typically use GRAS–certified products and don’t require premarket approval. Regulatory issues have mostly focused on product names and labels. Biologically, these products are distinct from the proteins that they emulate—they are designed to look, taste, and feel like seafood but differ on a molecular level.

Fermentation-enabled. Plant-based fermentation has three production methods, with biomass the most applicable to alternative seafood:

• Traditional fermentation refers to the practice of using microbes in food. To make protein alternatives, this process uses live microorganisms to modulate and process plant-derived ingredients. Nonseafood examples include fermenting soybeans for tempeh or using lactic-acid bacteria to make cheese.

• Biomass fermentation involves growing naturally occurring, protein-dense, fast-growing microorganisms, typically algae or fungi. Examples outside of alternative seafood include mycelium-based steak.

• Precision fermentation uses microbial hosts as cell factories to produce specific ingredients, such as enzymes, vitamins, and natural pigments. Examples include using hemeproteins to improve the taste of plant proteins and using microbes to produce dairy proteins, such as wheys and caseins.11

• Cultivated seafood. These seafood alternatives are produced from cells harvested from popular fish (salmon and tuna) or shellfish (crustaceans such as shrimp, crab, and mussels). The cells are then cultured within bioreactors and grown on biocompatible scaffolds, which provide structure to create three-dimensional tissues. The resulting mix of muscle and fat cells tastes similar to live-caught fish and does not require harvesting or farming live fish. These products are still in development and require high degrees of regulation and certification, as they rely on technologies that are new to the food space. With both high potential and high development costs, these products have captured significant interest and funding in alternative seafood.

The next wave: How the alternative-seafood industry can break through

The next wave: How the alternative-seafood industry can break through

Although alternative seafood offers significant potential for changing consumer preferences by meeting a demonstrated need, the industry still must work to identify target core consumers and develop messages that resonate with them. For example, the issue of ocean health is deeply important to many seafood consumers, yet it remains to be seen whether those consumers will bypass traditional fish for its alternatives. There is also additional opportunity for high-value products, which are the most susceptible to overfishing. While ultrapremium products may help with price parity, they are not well positioned to make a dent in traditional fish supply and demand.

Alternatives can also provide new sources of seafood while reducing the pressures on fragile aquatic ecosystems. However, there is major work ahead on scaling to levels that meet consumer taste and nutrition demands while delivering lower price points to better engage with nonpremium consumers. If companies can achieve wider distribution, they will be better able to reduce existing pressures on oceans and other aquatic ecosystems.

Finally, as with other alternative proteins, the alternative-seafood industry must navigate broader macroeconomic

pressures affecting consumers and investors while continuing to innovate in order to improve taste and cost. Once these products are more established in the market, it remains to be seen how consumers will respond, and how products continue to develop accordingly.

Clearly, alternative seafood offers significant potential impact. It can not only reduce the environmental impact of fishing and reduce pressure on fisheries but also provide a healthy alternative and expand access to protein in a more efficient manner. Understanding the barriers to scaling and learning from previous strides in alternative proteins will be critical to capitalizing on potential sources of advantage.