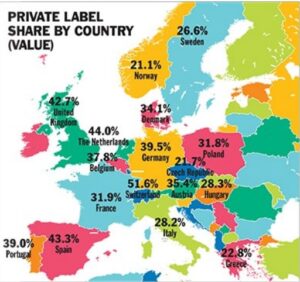

PLMA International Council reports an overall growth of private label shares in Europe across 17 countries including Scandinavia and CEE countries, according to the data of NielsenIQ. Compared to 2021, the value share in 2022 grew +1.2% to an impressive 37% of the grocery market in Europe which represent 302bln euros. Consumers in Europe clearly turned to private label acknowledging the quality and price value.

NielsenIQ surveyed 17 markets for PLMA’s International Private Label Yearbook and observed an increase for retail brands in 16 out of the 17 countries, the only exception is Switzerland that reported a decrease in the overall grocery purchase, including a slight decline in private label (- 0.4% vs last year). European markets remain however some of the biggest Private Label markets globally, 11 markets sustained their market share position well above 30%, and 4 markets remained above 40%.

The highest growth countries in private label share are the Czech Republic (+3.5%), Portugal (+2.9%), Spain (+2.2%) and Hungary (+2.2%). Switzerland remains the country with the highest share across the 17 countries tracked. The share of Switzerland in 2022 is 51.6%, the only country with a share higher than 50%.

The highest growth countries in private label share are the Czech Republic (+3.5%), Portugal (+2.9%), Spain (+2.2%) and Hungary (+2.2%). Switzerland remains the country with the highest share across the 17 countries tracked. The share of Switzerland in 2022 is 51.6%, the only country with a share higher than 50%.

Europe’s largest markets, Germany, United Kingdom and France, have a collective Private Label share of 38.5% in 2022, this share grew 1.1% vs last year. The highest share growth for the largest markets is visible in ambient food, pet food and paper products, all categories grew over 1% in share.

Spain with a market share of 43.3% and Portugal with 39% combined reported after the Czech Republic the highest share growth, which grew with +2.6% driven by perishable food and homecare. Italy with a market share of 28.2% maintains the steady growth that is seen in the past years supported by the highest category growth in frozen and ambient food.

Germany and Portugal are the two markets that reported growth in all product departments, food and non-food.

In Belgium and the Netherlands, the private label share combined grew with +0.9%, the highest growth for the 2 countries is visible in ambient food and paper products. A couple of categories show a decline in private label share with the biggest decline visible in Belgium in health care – 4.3%, however in the Netherlands healthcare shows a slight growth in Private label share.

Also the Scandinavian countries show growth in Private label share, together the countries grew +1.1% in share with the highest growth reported in Denmark of +1.8%. Growth of private label share is visible in all categories. The highest share growth is visible in homecare with an average growth of +2.4%.

Also the Scandinavian countries show growth in Private label share, together the countries grew +1.1% in share with the highest growth reported in Denmark of +1.8%. Growth of private label share is visible in all categories. The highest share growth is visible in homecare with an average growth of +2.4%.

In Eastern Europe the private label share is growing as well, highest growth in private label share is visible in perishable food with an impressive 7.2% growth in CZ and +4.5% in pet food in Hungary. A decline is visible in alcoholic beverages. In Austria the private label value market share rises +1.2% to 35.4%. The two categories that stand out with the highest growth are perishables and paper products.

In Greece the market share reaches nearly 23%, a growth of 1.3% vs 2021. The growth was registered in all categories, with the highest growth in confectionery and snacks, with the exception of alcoholic beverages which slightly declined with -0.4%.

According to NielsenIQ’s data, perishable and frozen food, paper products, and ambient food are the top 3 categories of Private Label value share with an average of 50% representing in total 212.8 billion in Euros across the 17 European countries tracked.

The private label sales grew with 25 billion euros across the 17 European countries tracked. Perishables and ambient food have the highest contribution to this growth.